Should we expand Social Security? Of course we should. We all know that old-style pensions have all but disappeared, replaced by 401(k) plans that are disastrously underfunded. Savings levels among pre-retirement Americans are low. Housing wealth has declined. For the lowest-income retirees, Social Security provides virtually their entire income. And various measures of “retirement readiness” suggest that most seniors won’t be able to sustain their normal lifestyle in retirement.

But there’s a problem with all this: it’s fundamentally anecdotal. Most Americans have never had any pension of any kind, even back in the good old days. Savings levels have always been low. Social Security has always provided the bulk of retirement income for the poor. And retirement readiness has been weak for a long time. What we’d really like to know is the trajectory of all this stuff when you add it all up. Are seniors doing better or worse than in the past?

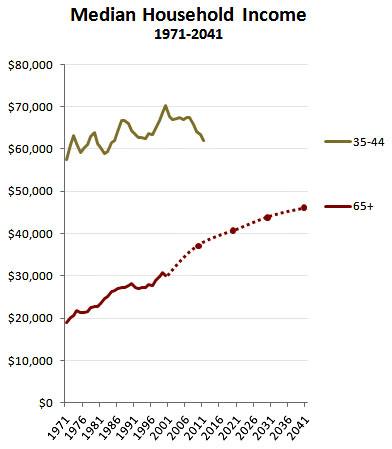

So I keep coming back to MINT. It comes from the Social Security Administration, not some think tank with an axe to grind, and as far as I know it’s the only projection of retirement income that accounts for everything in simple dollar terms: pensions, savings, Social Security, earnings, etc. I’ve  posted about the basic conclusions of MINT before, but here it is again: adjusted for inflation, median household income for retirees is projected to increase from about $20,000 in 1971 to $46,000 in 2041. During that same period, household income of prime-age workers seems likely to stay pretty flat. The latest MINT report is here.

posted about the basic conclusions of MINT before, but here it is again: adjusted for inflation, median household income for retirees is projected to increase from about $20,000 in 1971 to $46,000 in 2041. During that same period, household income of prime-age workers seems likely to stay pretty flat. The latest MINT report is here.

Now, this is still a two-edged sword. The MINT simulation projects that future retirees have better prospects than current retirees in absolute dollar terms. However, on average, their retirement income will be only 84 percent of their working income, compared to 95 percent for Depression-era workers (though that’s tricky to intepret since replacement rates are calculated on lifetime income, and will look higher when wages are rising than when they’re stagnant). Still, you can say there’s not a simple story to tell here. Retirees are doing well by one metric but not so well by another.

I don’t want to pretend that MINT is the ultimate statement of retiree prospects. Obviously it’s not. But the report I linked to above was written by two researchers from the Urban Institute and one from the Social Security Administration. It’s not some kind of right-wing agit-prop. Yet no one ever mentions it. I’ve heard endless horror stories about the collapse of retirement, but none of them ever engages with the MINT data, even though it’s easily the most straightforward and easy-to-understand projection we have.

For my money, I’d like to see Social Security increased for the lowest-income seniors. The minimum Social Security payout is pretty scandalous. High-income seniors, conversely, could probably get by with a lower growth rate in benefits than we currently envision. Obviously you can argue with this, and I’m not wedded to any particular plan. Beyond that, though, I’d sure like to see some real engagement with the MINT projections. Once you look beyond all the pretty but incomplete bar charts that litter retirement white papers, it suggests that we don’t really face a historic retirement crisis.

Maybe that’s wrong, and we really do. But let’s see the evidence. Tell me why MINT is wrong.